This summer everything is different, especially for the individuals, families and communities with connections to Canada’s many beloved holiday destinations. We are missing so many features of these places – cottages, camps, canoes, forests, lakes, shores, wildlife, hiking, swimming and each other.

Show everyone your favorite Canadian place and activity in American Friends of Canadian Conservation’s photography contest!

If you are passionate about Canada’s natural and cultural heritage, join your friends, family and neighbors for a virtual holiday by enjoying and sharing your own photographic memories, and seeing everyone else’s favorite corner of Canada. Give it your best shot! Inspire others with your images of Canada’s nature, offer a peek into your ideal vacation day, give your community a visual high-five for its special event, demonstrate your camera skills! The contest is open to all amateur photographers. Photos may be submitted between August 15, 2020 and September 15, 2020. You may vote anytime between now and September 30, 2020. The winners will be announced by October 15, 2020.

Select your best images in these seven categories:

- Landscapes (can include people, but they are not the subject)

- Water (can include people, but they are not the subject)

- People in Nature (primary subject is a person)

- Wildlife (including fish and insects)

- Plants, Trees and Flowers

- Events (public, community-oriented activities)

- Tradition (including built environment, man-made objects)

Visit American Friends’ Oh Canada 2020 Photography Contest to read about the contest rules, timing and Prizes!

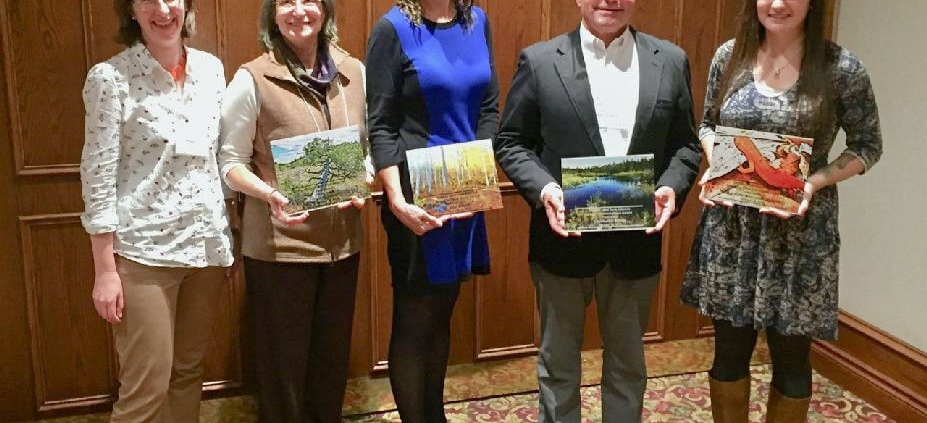

The winner of each category will be awarded a commemorative, dated decorative tile from Motawi Tileworks of Ann Arbor Michigan. View the stunning Motawi Tiles in greater detail.

Sandra Tassel

Sandra Tassel